inheritance tax rate in michigan

As of 2021 you can inherit up to 1170000000 tax free. Thus the maximum Federal tax rate on gains on the sale of inherited property is15 5 if the gain would otherwise be taxed in the 10 or 15 regular tax brackets.

Michigans income tax rate is a flat 425 and local income taxes range from 0 to 24.

. The sales tax rate across the state is 6. No exempted amount and the inheritance tax rates began at a 12 rate up to a 17 rate. For individuals who inherited from a person who passed away on or before September 30 1993 the inheritance tax remains in effect.

Its inheritance and estate taxes were created in 1899 but the state repealed them in 2019. The rate threshold is the point at which the marginal estate tax rate kicks in. As you can imagine this means that the vast majority of estates are not subject to a.

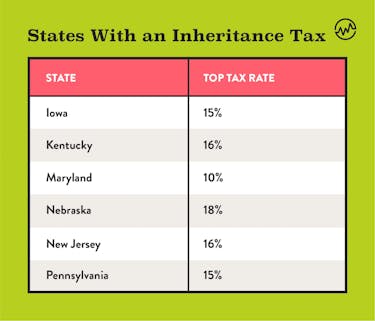

Inheritance tax occurs after the heirs receive their payouts. Michigan also does not have a gift tax. Of the six states with inheritance taxes nebraska has the highest top rate at 18 percent.

Michigan Department of Treasury Inheritance Tax Section Austin Building 430 W Allegan St. The estate would pay 50000 5 in estate taxes. Michigan does not have an inheritance tax.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. 1 2005 Michigan collected an estate tax called a pick up tax based on the amount the IRS received. Inheritance taxes are paid by beneficiaries of.

Lansing MI 48922. Its applied to an estate if the deceased passed on or before Sept. Some individual states have state estate tax laws but michigan does not.

Is there a contact phone number I can call. However it does not apply to any recent estate. An inheritance tax return must be filed for the estates of any person who died before October 1 1993.

In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. A copy of all inheritance tax orders on file with the Probate Court. Michigan does not have an inheritance tax.

In 2021 federal estate tax generally applies to assets over 117 million. You would receive 950000. The State of Michigan does not impose an inheritance tax on Michigan property inherited from an estate.

City Business and Fiduciary Taxes Employer Withholding Tax. Does Michigan Have an Inheritance Tax or Estate Tax. An inheritance tax a capital gains tax and an estate tax.

Some states also tax beneficiary inheritances based on your residence status and your relationship to the deceased. Thus the maximum federal tax rate on gains on the sale of inherited property is15 5 if the gain would otherwise be taxed in the 10 or 15 regular tax brackets. Connecticut continues to phase in an increase to its estate exemption planning to match the federal exemption by 2023.

The michigan inheritance tax. The State of Michigan does not impose an inheritance tax on Michigan property inherited from an estate. This means that in many cases an estate is taxed twice -- first by the federal estate tax then by the state inheritance tax.

The state of Michigan levies no inheritance tax or estate tax as of 2015 reports the Michigan Department of Treasury. You would pay 95000 10 in inheritance taxes. The Michigan inheritance tax was eliminated in 1993.

However as the exemption increases the minimum tax rate also increases. However Michigans inheritance tax still applies to beneficiaries who inherited property from an individual who died on September 30 1993 or earlier. There is no federal inheritance tax but there is a federal estate tax.

It is a tax on the amount received and is paid by the heir. Michigans income tax rate is a flat 425 and local income taxes range from 0 to 24. Inheritance taxes are levied by the states.

After much uncertainty Congress stabilized the Federal Estate Tax also known as the death tax. For most people there is no concern about Michigan estate or death taxes. The average effective property tax rate in Michigan is 145.

Thats because Michigans estate tax depended on a provision in. Its estate tax technically remains on the books but since 2005 there has been no mechanism for it to collect it. Anything over that amount is taxed at 40.

Michigan does not have an inheritance tax with one notable exception. Michigan does not have an inheritance tax with one notable exception. Michigans estate tax is not operative as a result of changes in federal law.

Where do I mail the information related to Michigan Inheritance Tax. Inheritance tax rate in michigan. The only death tax for Michigan residents is the federal estate tax levied on estates worth more than 543 million according to Nolo.

According to the Michigan Department of Treasury if a beneficiary inherits assets from a loved one who died after 1993 they do not need to pay inheritance tax to the state of Michigan. The estate includes cash on hand bank accounts. If you have a new job you can figure out what your take home pay will be using our Michigan paycheck calculator.

The top estate tax rate is 16 percent exemption threshold. You will pay 000 in taxes on the first 1170000000. As of 2021 you can inherit up to 1170000000 tax free.

Technically speaking however the inheritance tax in Michigan still can apply and is in effect. If you have questions about either the estate tax or inheritance tax call 517 636-4486. It only counts for people who receive property from someone who passed away prior to or on September 30 1993.

How Is Tax Liability Calculated Common Tax Questions Answered

Michigan Inheritance Tax Estate Tax Guide Rochester Law Center

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Is Your Inheritance Considered Taxable Income H R Block

Visualizing Unequal State Tax Burdens Across America Visualizing Unequal State Tax Burdens Across America What Percentage Of State Tax Finance Function Tax

Michigan Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Estate Tax Inheritance Tax Arizona Real Estate

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Michigan Inheritance Tax Estate Tax Guide Rochester Law Center

State Estate And Inheritance Taxes Itep

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Nightlife Travel

State Estate And Inheritance Taxes Itep

How To Avoid Estate Taxes With A Trust

Death Of The Death Tax Taxing Inheritances Is Falling Out Of Favour

401 K Inheritance Tax Rules Estate Planning

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit